north dakota sales tax online

Depending on local municipalities the total tax rate can be as high as 85. Currently combined sales tax rates in North Dakota range from 5 to 8.

North Dakota Nd State Tax Refund Tax Brackets Taxact

800 524-1620 North Dakota State.

. Ad State Tax Online Same Day. ND TAP uses industry standard security features like multi-factor authentication and allows you to. The North Dakota ND state sales tax rate is currently 5.

On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 35. Income Tax Withholding Forms. This permit will furnish your business with a unique sales tax number North Dakota Sales Tax ID Number.

Sales Tax Taxpayer Access Point TAP North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders. The North Dakota sales tax rate is 5. Sales Tax Rate Information.

Manage your North Dakota business tax accounts with Taxpayer Access point TAP. What is Taxpayer Access Point TAP If you hold a North Dakota sales and use tax permit you. With the launch of the new website also comes the release of the 2021 North Dakota income tax booklets and income tax forms and the 2022 income tax withholding tables.

Counties and cities can charge an additional local sales tax of up to 3 for a maximum possible combined sales tax of 8. North Dakota requires businesses to file sales tax returns and submit sales tax payments online. And even more so since Canadians can in certain circumstances obtain refunds of our states sales tax.

Registered users will be able to file and remit their sales taxes using a web-based PC program. To find the total sales tax rate combine the North Dakota state. Form 301-EF - ACH Credit Authorization.

The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656. The state sales tax rate for most purchases of tangible personal property in North Dakota is 5 and local governments can impose their own taxes as well. Filing Your North Dakota Sales Tax Returns Offline.

Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of State Tax Commissioner and does not file electronically. North Dakota individual income taxpayers you can also utilize TAP to make electronic payments check the status of your refund search for a. North Dakota Taxpayer Access Point ND TAP is an online system taxpayers can use to submit electronic returns and payments to the Office of State Tax Commissioner.

TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view payments edit contact information and more. Wednesday December 29 2021 - 0100 pm. North Dakota individual income taxpayers you can also utilize TAP to make electronic payments check the status of your refund search for a.

Once you complete the online process you will receive a confirmation with. With local taxes the. File the North Dakota Sales Tax Return You will do this with the North Dakota Sales Tax E-File page of the North Dakota Taxpayer Access Point.

One North Dakota Login and password to access multiple ND Online Services. Register online for a North Dakota Sales Tax Permit by completing the simple and secure online form questionnaire in just a few minutes. Sales Tax Rates in North Dakota.

This free and secure site allows taxpayers to manage their North Dakota tax accounts from any device at any time. Once you have completed your required reportings you can mail it to the state. The North Dakota Office of State Tax Commissioner is pleased to announce the launch of its new website wwwtaxndgov.

So no matter if you live and run your business in North Dakota or live outside North Dakota but have nexus there you would charge sales tax at the rate of your buyers ship-to location. The North Dakota use tax rate is 5 the same as the regular North Dakota sales tax. NORTH DAKOTA SALES TAX PERMIT APPLICATION.

2022 Current Resources- State Tax Online. Register once for secure access to State services. Link sends email Federal adjusted gross.

Link sends email Federal adjusted gross income of 32000 or less. Tax ID Bureau eServices stays current with the changing laws forms and documents in order to ensure a smooth quick and efficient sales tax registration for your business. Sales and Use Tax Rates Look Up.

Limited to 3 returns per computer. Including local taxes the North Dakota use tax can be as high as 3000. Manage your North Dakota business tax accounts with Taxpayer Access point TAP.

New to North Dakota Online Services. Form 306 - Income Tax Withholding Return. Discover More Of The Spirit Of North Dakota Shopping opportunities are great at the malls and the shopping areas in North Dakota.

Local Jurisdiction Sales and Use Taxes. Groceries are exempt from the North Dakota sales tax. North Dakota assesses local tax at the city and county levels but does not assess local tax for special jurisdictional areas such as school districts or transportation authorities.

Register for a North Dakota Sales Tax Permit Online by filling out and submitting the State Sales Tax Registration form. For assistance with this North Dakota Login contact the Service Desk. State Sales and Use Tax Rate.

While it is highly recommended that you file online using the North Dakota Taxpayer Access Point TAP website it is possible to file your required sales tax reportings offline using North Dakota filing frequency which you can download and print here. That means the effective rate across the state can vary substantially with the combined state and local rate in some places reaching 85. The North Dakota use tax should be paid for items bought tax-free over the internet bought while traveling or transported into North Dakota from a state with a lower sales tax rate.

North Dakota is a destination-based sales tax state. Benefits of North Dakota Login. 31 rows The state sales tax rate in North Dakota is 5000.

TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view payments edit contact information and more. FREE FEDERAL AND STATE RETURN IF YOU MEET THE FOLLOWING. North Dakota first adopted a general state sales tax in 1935 and since that time the rate has risen to 5.

Read through the FAQ.

North Dakota State Tax Software Preparation And E File On Freetaxusa

Ndtax Department Ndtaxdepartment Twitter

North Dakota Income Tax Return For 2021 In 2022 Prepare And Efile

North Dakota Income Tax Brackets 2020

How To Register For A Sales Tax Permit Taxjar

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

Ndtax Department Ndtaxdepartment Twitter

South Dakota Sales Tax Small Business Guide Truic

North Dakota Charitable Registration Harbor Compliance

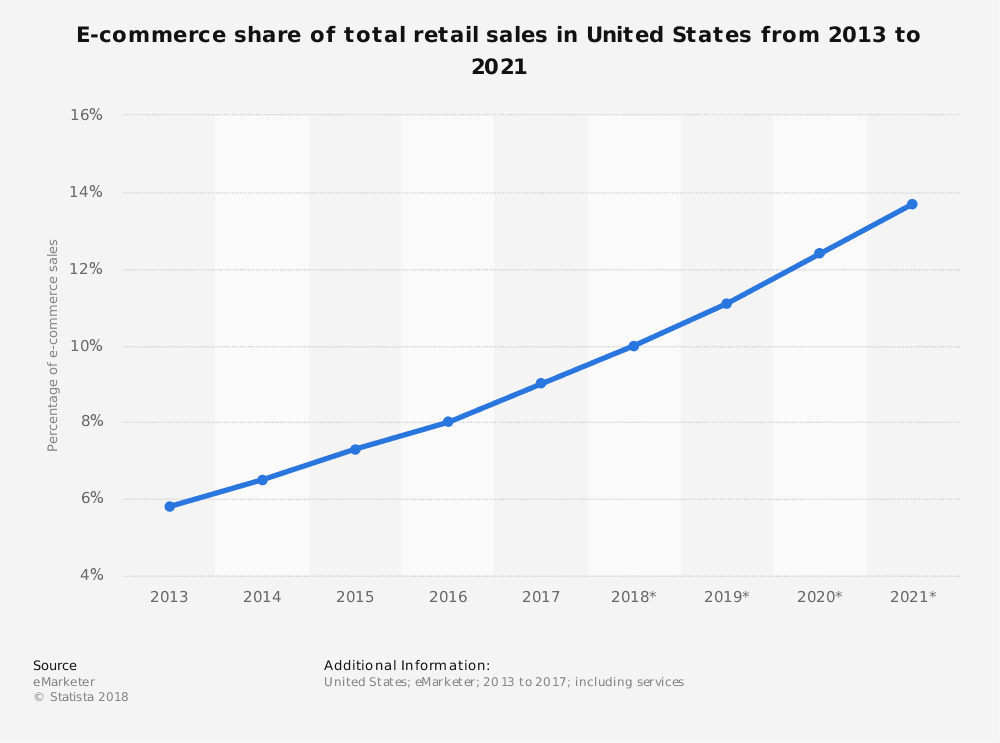

E Commerce And Sales Tax Youtube Sales Tax Commerce Ecommerce

Income Tax Update Special Session 2021

Sales Use Tax South Dakota Department Of Revenue

3 Things You Need To Know About Internet Sales Tax After Wayfair Red Stag Fulfillment

File And Pay Your Sturgis Rally Sales Tax Online South Dakota Department Of Revenue

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)